Interest rates on pause for now, but will we see more cuts this year?

South Africa could see another three interest rate cuts between now and mid-2027, analysts predict.

Image: AI / ChatGPT

South African interest rates are on hold for now, with the South African Reserve Bank (SARB) having opted to keep the repo rate unchanged at 6.75% during its first Monetary Policy Committee (MPC) meeting, held on Thursday, January 29.

This means South Africa’s prime lending rate remains at 10.25%.

Four members of the MPC voted in favour of a rate hold while two members signalled a preference for a 25-basis-point cut. This follows December’s headline Consumer Price Inflation (CPI) figure, which increased slightly to 3.6% year-on-year, from November’s 3.5%.

SARB Governor Lesetja Kganyago indicated that December’s CPI figure was likely the ‘peak’ and that the Reserve Bank expected inflation to ease during 2026.

This is in line with the predictions of most analysts, and given the current projections, South Africa is likely to see about three more interest rate cuts in the next 18 months, says Nolan Wapenaar, head of fixed income at Anchor Capital.

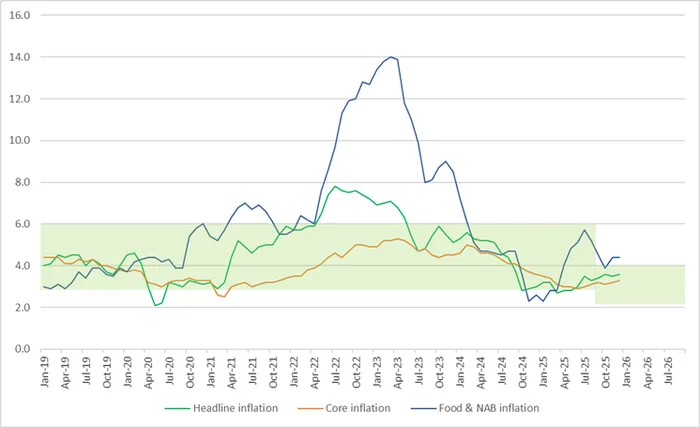

South Africa's inflation rate over the last seven years.

Image: Anchor / Stats SA

“The SARB’s Quarterly Projection Model (QPM) continues to indicate gradual rate reductions as inflation converges towards the target, although decisions will remain data-dependent and assessed meeting-by-meeting,” Wapenaar said.

“The model suggests that SA will move from a slightly restrictive monetary policy stance toward a neutral stance in 2027. This implies three more interest rate cuts of 0.25% each between now and mid-2027, assuming that the economy progresses in line with the model,” he added.

However, services and food inflation, which are currently both above 4%, and aggravated in the latter case by the foot-and-mouth disease outbreak, remain risks to the overall inflation outlook. Electricity prices remain a concern too, especially given much-publicised miscalculations by the National Energy Regulator of South Africa (NERSA), which could lead to a revenue shortfall of R76 billion, likely to be passed on to consumers.

South Africa’s annual inflation rate for 2025 was 3.2%, which was the lowest in 21 years.

Assuming there are no major shocks or setbacks, the SARB seeks to see inflation reduce in line with projections before a likely interest rate cut at the MPC’s next meeting in March, Wapenaar said.

Investec economist Lara Hodes concurs that South African inflation expectations have eased.

“The robust domestic currency, supported by a sluggish greenback and the surge in precious metals prices, has seen the SARB’s near-term inflation outlook fall to 3.3% y/y for 2026, from 3.5% y/y previously. However, upside risks remain, notably from inflated electricity prices.”

Furthermore, a fourth-quarter 2025 survey by the Bureau of Economic Research showed that average inflation expectations among the three professional groups slid markedly, Hodes added.

Bradd Bendall, BetterBond’s national sales head, is another commentator who expects more interest rate cuts in the coming year.

“Looking ahead, with inflation remaining within one percentage point of the Reserve Bank’s 3% target and the rand holding firm against major currencies, conditions remain supportive for another cut in the prime lending rate in the coming months,” Bendall said.

IOL Business

Get your news on the go. Download the latest IOL App for Android and IOS now.

Related Topics: