SA insurers expose shocking ‘kill-for-cash’ schemes and fraud frenzy

Murder, Mistakes, and Millions: SA Insurers Expose Shocking ‘Kill-for-Cash’ Schemes and Fraud Frenzy

Image: Ai-Generated/Sora

From shocking “murder for money” cases to bank errors that drained customer accounts, South Africa’s financial watchdogs and insurers are uncovering fraud and fixing costly mistakes – and the amounts involved run into the hundreds of millions.

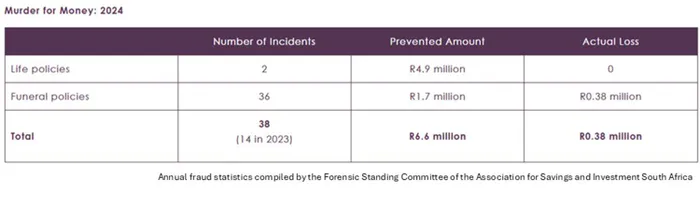

In fact, in the past year, of the 5 505 fraudulent and dishonest life insurance claims recorded by Association for Savings and Investment South Africa (ASISA) members, 38 were murder for money cases, its latest report showed.

Jean van Niekerk, convenor of the ASISA Forensic Standing Committee, said that while all types of fraud and dishonesty are of concern, the industry is particularly focused on stamping out murder for insurance payouts and deceased estate fraud.

In addition, ASISA members have picked up on criminal syndicates identifying deceased estates as a lucrative way of accessing large amounts of money, preying on people’s grief and the slow and arduous processes involved in winding up the financial affairs of a deceased family member

Although the numbers are still relatively low, incidents detected have tripled from 54 in 2023 to 161 in 2024. Even more concerning is the significant rand value of the fraud prevented. “If we had not detected the 161 cases last year, our industry and beneficiaries would have lost R220 million to criminal syndicates,” says Van Niekerk.

Of the 5 505 fraudulent and dishonest life insurance claims recorded by Association for Savings and Investment South Africa last year, 38 were murder for money cases.

Image: ASISA

These findings form part of ASISA’s annual fraud statistics compiled by its Forensic Standing Committee. It stated that its members detected 16 520 cases of fraud and dishonesty in 2024 – up 26% from 13 074 cases the previous year. Insurers and investment firms prevented losses of about R1.4 billion, although criminals and dishonest policyholders still cost the industry R131.6m.

Van Niekerk said the loss represents just 0.02% of the R639bn in honest claims paid in 2024. He attributed the lower losses to improved detection tools and forensic teams.

“Our industry has always been seen as a soft target by criminals and dishonest individuals because of the significant amounts of investments and benefits being managed, but it is getting increasingly difficult to get away with fraud and dishonesty,” he said.

Remuneration fraud, where agents or advisers dishonestly claim commissions or fees, accounted for more than half of all cases. Life insurance claim fraud was the second-largest category, while fraudulent withdrawals and disinvestments were the only area to see fewer cases, although actual losses there increased slightly.

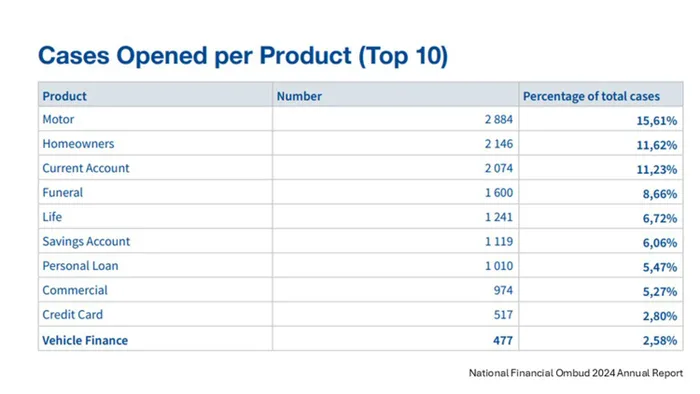

Meanwhile, honest customers are having to deal with miscommunication and unlawful deductions. Last year, the newly created National Financial Ombud Scheme South Africa (NFO) secured R328.5 million in refunds for aggrieved customers who complained about financial institutions.

Its annual report shows that of the 28 002 complaints it handled between January and December 2024, 30% related to fraud. Maladministration by financial institutions and complaints from debt-stressed consumers were the second- and third-highest categories.

“These trends align with patterns observed in previous years, where fraud-related disputes consistently accounted for a significant portion of complaints,” the report noted.

One case involved a South African customer who signed up for a personal loan over the phone. She believed the interest rate was 19.25%, only to later discover it was 29.25%. She asked the bank to review the rate.

The bank said the higher rate was correct, based on her credit profile, and was legal. But when the NFO investigated, it listened to the call recording and found the customer had repeatedly complained about poor line quality. “Based on the call it was probable that the complainant did not hear the interest rate correctly,” the report said of this anonymous example.

Top complaints to the National Financial Ombud in 2024.

Image: NFO

Because of the bad call quality, there were doubts about whether she fully understood or agreed to the 29.25% rate. South African contract law requires both parties to agree clearly (a meeting of the minds), and banks must make sure customers understand the terms and risks of credit agreements.

After mediation, the bank agreed to reduce the interest rate to 19.25% and refunded the difference from the start of the loan.

In another case, a customer found R1 689.88 had been taken from his account without notice, leading him to lodge a fraud complaint. He had made a payment of R3 000 to a beneficiary, but a bank system error reversed it and credited the money back to him. He then paid it again – and the beneficiary ended up receiving both payments.

Instead of fixing the error, the bank deducted R1 689.88 from his account and flagged a balance owing. The NFO found that the customer was not at fault and that the bank should have dealt directly with the beneficiary who was unjustly enriched. The bank refunded the customer and removed the flag from his account.

Nerosha Maseti, Lead Ombud of the Banking Division, said “bank customers have every right to expect good service and for complaints to be taken seriously”.

IOL