2025 tax season alert: SARS cautions public about fake refund audit SMS

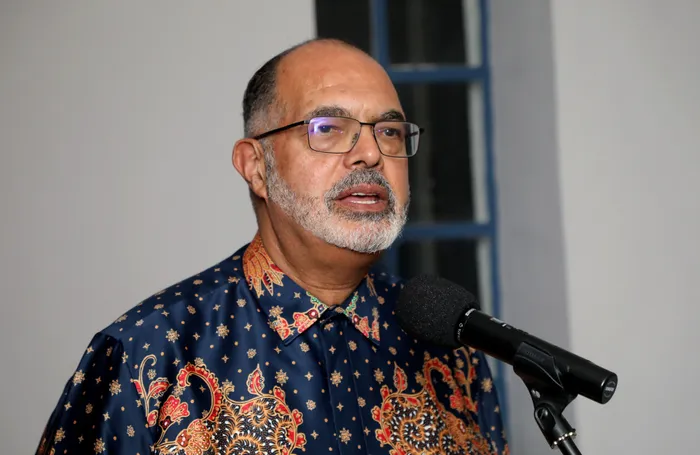

SARS Commissioner Edward Kieswetter

Image: Timothy Bernard / Independent Newspapers

As the 2025 tax season looks set to begin, the South African Revenue Service (SARS) has issued a fresh warning to taxpayers about a new scam designed to steal personal information under the guise of a tax refund audit.

IOL previously reported that the revenue collector announced that tax season would run from July 7 to October 20 for most individuals, with many being auto-assessed based on third-party data.

"The taxpayers in the auto assessment category do not have to do anything if they are satisfied with the calculation on their tax returns," SARS said.

"If the taxpayer is of the opinion that SARS has not captured all the necessary information, they are free to make changes on their tax returns and submit the missing information through eFiling by October 20."

The revenue collector said taxpayers who are not automatically assessed must file their tax returns themselves. Filing opens on July 21 and closes on October 20 2025 for non-provisional individuals.

However, while the streamlined process was intended to make filing easier, scammers are now exploiting the period of increased taxpayer activity. According to SARS the latest scam involves an SMS that claims that a revenue collector is auditing a tax refund.

"The latest scam is a SMS indicating that SARS is conducting an audit on a Tax refund. The link leads you to a phishing website, aimed at stealing your information. See the scam prototype here".

The revenue collector also advised taxpayers to verify that any emails or SMS messages claiming to be from SARS are authentic before clicking on any links.

"Always make sure the email or SMS is genuine before you click on any link,".

In a separate advisory, the revenue collector reiterated that it will never ask for personal, tax, banking or eFiling details via email or SMS, nor will it send hyperlinks to external websites.

Sars said taxpayers should take note of the following:

- Do not open or respond to emails from unknown sources.

- Beware of emails that ask for personal, tax, banking and eFiling details (login credentials, passwords, pins, credit / debit card information, etc.).

- SARS will never request your banking details in any communication that you receive via post, email, or SMS. However, for the purpose of telephonic engagement and authentication purposes, SARS will verify your personal details. Importantly, SARS will not send you any hyperlinks to other websites – even those of banks.

- Beware of false SMSs.

- SARS does not send *.htm or *.html attachments.

- SARS will never ask for your credit card details.

mthobisi.nozulela@iol.co.za

IOL Business

Get your news on the go, click here to join the IOL News WhatsApp channel

Related Topics: