INVESTIGATION | Illicit cigarettes, legal loopholes, and billions gone: SA's hidden crisis

IPSOS found that illicit cigarettes are available in roughly three out of four stores (76.6%), with some packs selling for as little as R5 per 20-pack.

Image: Freepik

On the streets, a pack of cigarettes might seem harmless. In South Africa, they are anything but.

Illicit tobacco is more than a smuggling problem – it’s a multi-billion-rand industry that robs the country of revenue, fuels organised crime and exploits financial gaps that once landed South Africa on the Financial Action Task Force (FATF) greylist.

Revenue from these activities has contributed to high-level corruption, political party funding, and other criminal endeavours, making the consequences of illegal cigarettes a concern for every South African, according to the Institute for Security Studies (ISS).

For ordinary South Africans, this means less money for public services, weakened law enforcement, and risks that extend far beyond smoking.

The scale of the illicit trade

In fact, illicit trade in tobacco and alcohol alone is estimated to cost the government R30 billion a year in lost revenue.

This is according to the South Africa Illicit Economy 2.0 Report, launched by the Transnational Alliance to Combat Illicit Trade (TRACIT) in conjunction with Business Unity South Africa.

“Illicit trade continues to pose a serious threat to South Africa’s economic stability, governance, and international standing,” the report said.

Part of a broader illicit economy

The illegal cigarette trade forms part of a broader illicit economy, according to Richard Chelin, a researcher, and Rumbidzai Nyoni, a digital communication officer with the ENACT project at the ISS.

They have written that this economy also includes counterfeit goods, motor vehicles, clothing and textiles, movies and music.

“The revenue from this has also contributed to high-level corruption, political party funding and other criminal endeavours,” they said.

According to a Parliamentary written reply by Minister of Finance Enoch Godongwana earlier this year, up to 70% of cigarettes sold in South Africa are illicit, resulting in annual tax revenue losses exceeding R27 billion.

Tricky accounting

“By its very nature, illicit trade and smuggling is hard to reliably quantify. Over the past five years, South Africa’s illicit cigarette trade has escalated into a significant economic and enforcement challenge,” said Godongwana.

Revenue collection from tobacco and cigarette products fell from R13.4 billion in 2015/16 to R9.4 billion in 2024/25, a contraction of R4 billion (29.6%), with a 44.9% drop in 2020/21 due to COVID-19 lockdowns.

Despite the large profits generated, the penalties associated with illicit cigarette trafficking were moderate when compared with crimes such as drug or weapons trafficking, Chelin and Rumbidzai said just after the end of COVID-19.

Government action

Godongwana said that government is putting systems in place to counteract this trade.

For example, the minister said that the South African Revenue Service (SARS) has responded with a coordinated, multi-pronged strategy.

Front-line interceptions and seizures at ports of entry are conducted jointly with other government agencies, while compliance audits track tobacco from raw materials to factory production, allowing authorities to calculate output and detect irregularities.

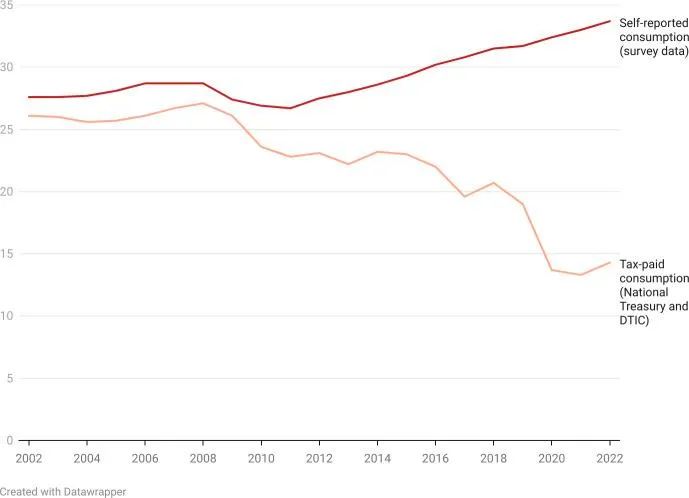

The widening gap between self-reported consumption and tax-paid consumption (billions of cigarette sticks).

Image: PubMed: Nicole Vellios & Corné van Walbeek

Ghost exports

High-risk operations to intercept and confiscate illegal cigarettes are carried out by the Customs National Rapid Response Team, backed by the National Targeting and Operations Centre, which inspects manufacturing warehouses.

CCTV monitoring and mandatory cigarette counters help track production in licensed facilities.

SARS’s Syndicated Tax and Customs Crimes Investigations division investigates smuggling, diversion, ghost exports, and misdeclarations in high-risk industries, including tobacco.

“Ghost exports” refer to fraudulent or illicit export schemes, often involving faking documents or goods to claim VAT refunds or evade sanctions

Internationally, SARS relies on agreements with other countries to share information and target illicit networks.

Revenue from iIlicit tobacco has contributed to high-level corruption, political party funding, and other criminal endeavours.

Image: ChatGPT

Enforcement results

The results of this strategy are measurable.

In 2024/25, arrests included a 44-year-old foreign national at Beitbridge Port of Entry and a 33-year-old Ethiopian national in Limpopo, allegedly involved in smuggling and money laundering, said Godongwana.

Over five years, SARS’s Criminal Investigation unit submitted 129 Customs and Excise cases to the National Prosecuting Authority (NPA). As of July, 105 remain on the NPA's roll, 33 are on trial, and 72 await trial dates, said Godongwana.

Eight cases involve illicit cigarettes, with four on trial and four pending allocation. Thirty-two cases led to convictions, the Parliamentary reply states.

The market in numbers

The scale of the illicit market is stark. Tax Justice South Africa, citing an IPSOS survey, found that illicit cigarettes are available in roughly three out of four stores (76.6%), with some packs selling for as little as R5 per 20-pack.

Ipsos was commissioned by British American Tobacco South Africa to carry out research into the cheapest purchase prices in the tobacco cigarette market.

Yusuf Abramjee of Tax Justice South Africa said, “We’re witnessing the collapse of tax compliance in the tobacco sector… Illicit cigarettes are moving in enormous quantities, undermining government revenue and enforcement efforts.”

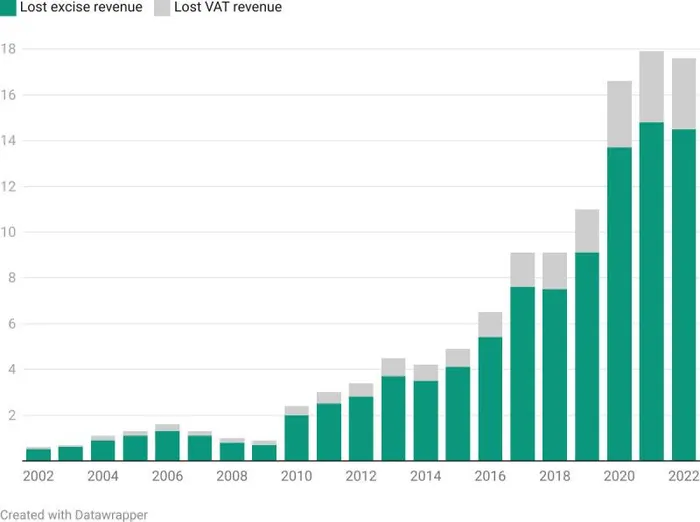

Lost excise and VAT revenue (billions of rands, 2022 prices).

Image: PubMed: Nicole Vellios & Corné van Walbeek

High-profile legal milestone

A high-profile legal milestone came at the end of October, when the Pretoria High Court granted provisional sequestration against Roy Muleya, who the agency said, “was found to be one of the main role players in a scheme which involved the importation of tobacco by entities who had no obvious links to registered cigarette manufacturers”.

SARS’ case was premised on the fact that Muleya actually owed it R155 million in excise duties.

SARS Commissioner Edward Kieswetter said at the time that it would “relentlessly pursue legally all those who are disregarding the law by seeking to bypass it… For all are equal before the law.”

FATF greylisting and reform

TRACIT’s report, released earlier this year, noted that South Africa’s inclusion on the greylist in February 2023 “highlights persistent deficiencies in combating money laundering and terrorist financing, undermining confidence in the country’s financial systems”.

It specifically said that “robust anti-money laundering and counter-terrorism financing frameworks are essential to disrupt the financial channels sustaining illicit trade networks.

In October, South Africa was removed from the list, having addressed all the deficiencies that were identified by the FATF, after South Africa was greylisted in February 2023.

The FATF specifically highlighted terrorist financing as an issue and one of the reasons the country was listed – a move that hindered international investment.

IOL BUSINESS