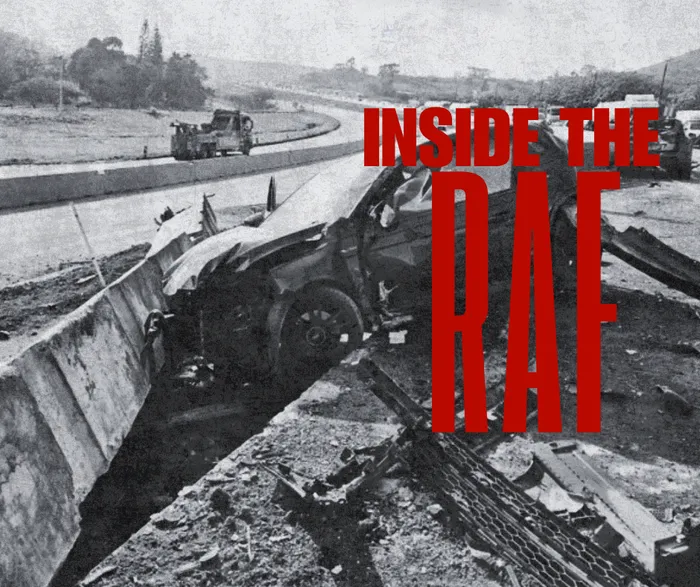

Inside the RAF | Fixing South Africa’s broken Road Accident Fund will be no easy task

South Africa’s Road Accident Fund (RAF), once seen as a safety net for crash victims, is now drowning in debt and mismanagement - and experts warn that fixing or replacing it will be one of the country’s toughest public finance challenges.

Image: IOL Graphics

Replacing or reforming South Africa’s troubled Road Accident Fund (RAF) will be a significant challenge, experts say, due to systemic failures that have plagued the institution and its predecessors.

Established to protect those injured or killed on the country’s roads from financial ruin, the RAF is funded through a fuel levy of R2.18 per litre. The fund was originally designed to provide support to all victims, regardless of fault.

However, the levy has remained unchanged since 2019, despite rising medical and legal costs. As a result, the RAF’s liabilities now exceed R518 billion, with assets of just R33 billion—meaning it owes roughly 15 times more than it owns.

The Auditor-General has repeatedly warned that the RAF’s finances are “not fairly presented”, citing “material uncertainty” over its ability to continue operating.

Poor governance and corruption

Many victims and civil society organisations say the RAF has failed to deliver justice.

Over the years, the fund has become embroiled in disputes involving lawyers, claimants, and the state, with funds allegedly diverted away from crash victims.

Speaking to IOL News, Professor Pfano Mashau of the Durban University of Technology, an expert in governance and economic development, described the RAF as emblematic of a broader public sector crisis.

“Public entities are losing billions annually due to poor governance, procurement failures and weak financial management,” Mashau said. “The Road Accident Fund is among the most concerning cases.”

Despite billions collected annually via the fuel levy, he noted that spiralling admin costs, legal fees and PR contracts have cast doubt on the fund’s accountability.

“The leadership is watching the ship sink rather than steering it forward,” he added, criticising the lack of a standardised methodology or performance measures.

Mashau cited regular breaches of the Public Finance Management Act (PFMA), including irregular, unauthorised and wasteful expenditure. These reportedly include contract irregularities, improper payments, and penalties for late payments.

He blamed “weak internal controls, political interference and a lack of consequence management” for the RAF’s decline.

“Even when wrongdoing is exposed through forensic probes, disciplinary and criminal actions are often delayed or dropped,” he said.

Systemic weaknesses

Mashau said the RAF is beset by illegal payments, botched settlements, and default judgments totalling billions. He proposed an automated claims system to reduce fraud and accelerate payouts.

“Transparent algorithms could minimise waste—possibly even freeing funds to reward good management. Instead, executives get bonuses while victims wait years.”

Persistent audit failures

At a recent meeting of Parliament’s Standing Committee on Public Accounts (Scopa), the Auditor-General’s office reported five consecutive disclaimers and adverse audit opinions.

Senior manager for the RAF at the Auditor-General’s office, Siphesihle Mlangeni, said the fund’s use of the IPSAS 42 framework—unapproved for South African public entities—had caused “pervasive material misstatements”.

The RAF’s accumulated deficit has grown from R13.6 billion in 2020/21 to R27.8 billion by 2024/25.

Mlangeni also flagged procurement failures, vacant executive positions, and soaring default judgments—from R1.6 billion to nearly R4 billion in a year. Two recent irregularities alone—unauthorised banking detail changes and overpaid claims—have cost more than R42 million.

The RAF is currently challenging these findings at the Constitutional Court.

Reform or replacement?

Wayne Duvenage, CEO of the Organisation Undoing Tax Abuse (OUTA), argued that the RAF’s model could still succeed if properly managed.

“The fund can meet its mandate with good systems and leadership. The problem is mismanagement and cadre deployment,” he said.

Duvenage added that reforming the RAF would likely be cheaper than starting from scratch. “We collect nearly R50 billion a year through the levy—that should be enough.”

He also stressed the need for a comprehensive road safety campaign.

Professor Jannie Rossouw from Wits Business School warned that designing a replacement system would be complex. “South Africa previously used a third-party insurance model. Replacing the RAF would raise difficult questions.”

Lessons from abroad

Kenya operates a fault-based system, requiring third-party insurance. Victims claim from the at-fault driver’s insurer—a slow and often unsuccessful process.

In Australia, several states use no-fault or hybrid systems. For example, the Australian Capital Territory’s scheme provides benefits to all injured parties for up to five years. Western Australia runs a no-fault fund for catastrophic injuries.

The human cost

The Law Society of South Africa (LSSA) said the RAF’s delays in compensation and rehabilitation worsen victims’ suffering.

“The gap between injury and compensation is too long,” said Jacqui Sohn, of the LSSA’s Personal Injury Committee.

She warned that alternatives such as the Road Accident Benefit Scheme (RABS) could exclude vulnerable claimants.

“Unless premiums are collected through a fuel levy, insurance-based systems will be unaffordable. A RABS-style model risks leaving victims reliant on overburdened public hospitals, without compensation for pain and suffering.”

Sohn said a properly funded RAF model could still work—if linked to other agencies for faster registration, investigation, and interim payments.

A cultural problem

Mashau blamed “state waste” on a broader culture of impunity.

“People are used to ignoring the PFMA. Every year, we see hundreds of millions wasted—with no consequences.”

He criticised the RAF’s spending on PR and executive perks. “Glossy billboards won’t hide a broken system.”

Mashau called for a leadership overhaul: “Boards should include finance and legal experts—not political loyalists.”

“Reform requires brave, ethical leaders committed to doing the right thing. Our financial problems stem not from a lack of funds—but from funds being stolen or misused.”

Earlier this month, the RAF announced a record R694 million payout in one day and said it had disbursed R17.3 billion since April, including R4.18 billion in September alone, as part of a turnaround strategy.

Sohn said the state must ensure any new or revamped system is well run. “Properly managed, the RAF can still deliver dignity and fairness to road crash victims.”

simon.majadibodu@iol.co.za

IOL News