Don’t be a victim. Take control with the SCAM framework amid South Africa’s rising scam wave

South Africa remains one of the most targeted countries for scams and cybercrime, with recent reports showing rising fraud losses of more than R2.2 billion annually.

Image: DALL-E

With cybercrime surging across Africa, South Africa has emerged as one of the continent’s most intensely targeted hotspots.

From infostealer and ransomware attacks to pervasive phishing and impersonation schemes, fraud is affecting a growing number of citizens and organisations. The stakes are high, but education and vigilance can turn the tide.

And on the bright sude, Anglo American’s SCAM framework offers the clarity and strategy needed to regain control.

Cybercrime on the Rise: What Recent Data Reveals

- In the biannual ESET Threat Report (June–November 2024), South Africa accounted for over 40% of ransomware attacks and nearly 35% of infostealer incidents across Africa. Phishing remained the most prevalent threat continent-wide at 34% of all detected attacks.

- According to Interpol’s 2025 Africa Cyberthreat Assessment, in some regions scam notifications have spiked by up to 3,000%. Cybercrime now constitutes more than 30% of all reported crime in both Western and Eastern Africa. .

- In South Africa alone, 17,849 ransomware detections were recorded in 2024 – making it the second-most targeted country after Egypt, according to the MyBroadbandAfrica Defence Forum.

- TransUnion’s H1 2025 Omnichannel Fraud Report revealed that 68% of South Africans reported being targeted by fraud (via email, phone, online or text) between August and December 2024. About 13% said they fell victim, and 33% lost money in that period.

- The Southern African Fraud Prevention Service (SAFPS) prevented about R5 billion in fraud in 2024 alone (compared to R7 billion in 2023), fielding more than 72,000 calls to assist potential victims in South Africa.

- A 32% year-on-year increase in reported fraud incidents was recorded in 2024, as noted by SAFPS. Predominant areas targeted include banking (45%), microfinance (19%), and clothing retail (14%).

- A KnowBe4 African Cybersecurity & Awareness Report (2025) estimated that consumers lost over R1 billion in 2023 due to digital banking and mobile app crimes. Alarmingly, 35% admitted to losing money to scams, and 32% had clicked on phishing emails.

- TechCabal reports that digital banking fraud has surged by 45% and related financial losses by 47%, leaving millions vulnerable. Total annual losses in South Africa are estimated at R2.2 billion (≈ US$118 million).

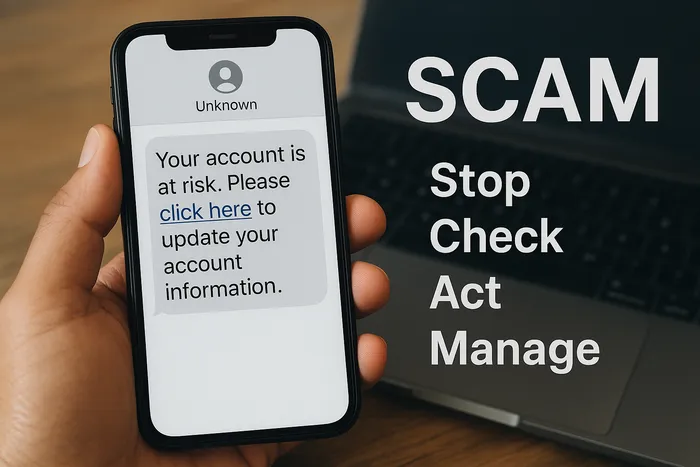

Introducing the SCAM Framework: A Smart Defense

Anglo American’s anti-fraud initiative introduces the easy-to-recall SCAM framework, a four-step guide empowering individuals to intercept fraud before it gains traction:

- S – Stop: Don’t succumb to pressure. Scammers thrive on creating urgency. Pause, breathe, and evaluate requests, especially those demanding money, personal details, or urgent action.

- C – Check: Scrutinise everything. Verify sender addresses, inspect messages for typos or odd links, and treat overly attractive offers as red flags.

- A – Act: Only take action when safe. Reach out to official organisations via verified contact points, consult someone you trust, and never share sensitive info or make payments based on unsolicited communications.

- M – Manage: Stay vigilant. Even after verifying a request, monitor your accounts and devices. Scammers often resurface with new attempts.

“In today’s digital world, awareness is the greatest defence against fraud,” says Ernest Mulibana, Anglo American’s External Communications Manager. “Our SCAM framework empowers people to take control ... By stopping, checking, acting safely, and managing ongoing vigilance, anyone can protect themselves against scammers.”

Essential Prevention Tips

- Verify before trusting – If “your bank” calls unexpectedly for your details, hang up and dial the official number yourself.

- Guard your personal info – No legitimate organisation will ask for passwords, PINs, or OTPs by cold email or call.

- Be wary of urgency – Fraudsters rely on pressure. No matter the deadline, take time to think.

- Update your software – Keep devices patched and protected with quality antivirus tools.

- Monitor accounts regularly – Review statements and credit activity for unauthorised activity.

- Trust your gut – If something feels off, investigate further before proceeding.

Also, document suspicious attempts, report them to appropriate authorities, warn your network, and continue monitoring.

Why SCAM Matters: Building Digital Resilience

Adopting the SCAM approach doesn’t just protect you, it helps fortify your broader community.

“Every person who learns to recognise and resist scams becomes a guardian for their family, friends, and colleagues,” Mulibana emphasises, reinforcing that collective awareness can strengthen South Africa’s digital defence ecosystem.