Used Chinese cars gain ground as South Africans chase value in 2025

A familiar sight on South African roads, the Haval H6 continues to perform strongly on the used market.

Image: Supplied / AutoTrader

THERE used to be a joke about a man who was convinced by a pushy salesman to buy himself a brand new Chinese sportscar, despite wanting a high-performance Teutonic turbocar. So convincing was the salesman that he purchased the car, but a couple of days later he was back at the dealership complaining about the car’s performance.

The salesman who sold him the car asked him why he was unhappy.

“Come outside,” said the man, “and I’ll show you what I mean.” So they go outside, and the man points to a hill just further down the road.

“You see that hill there? Every time I go up there, I can’t get past 60.”

The salesman looks at the hill, and shrugs. “You know, it's a pretty steep incline. For a Chinese car, 60 really isn’t that bad. I don’t see the problem.”

The man glares at the salesman as he replies, “The problem is that I live at No.65.”

That joke may have had merit a few decades ago, but these days that narrative has been turned on its head. In fact, these days South African motorists are no longer laughing off Chinese vehicles — especially in the used-car market.

New data from AutoTrader shows a clear shift in buyer behaviour, with brands like Chery, Haval, GWM and Omoda now firmly established among the country’s most popular second-hand choices. Once viewed as cheap alternatives, Chinese cars are increasingly recognised for offering competitive quality, strong specifications and attractive pricing.

While sales of new Chinese vehicles continue to grow — with Omoda and Jaecoo alone selling nearly 2,500 units in the third quarter of 2025 — the used market tells an equally compelling story.

Buyers, it seems, are backing their curiosity with their wallets.

New data from AutoTrader shows a clear shift in buyer behaviour, with brands like Chery, Haval, GWM and Omoda now firmly established among the country’s most popular second-hand choices. Once viewed as cheap alternatives, Chinese cars are increasingly recognised for offering competitive quality, strong specifications and attractive pricing.

Image: Supplied / AutoTrader

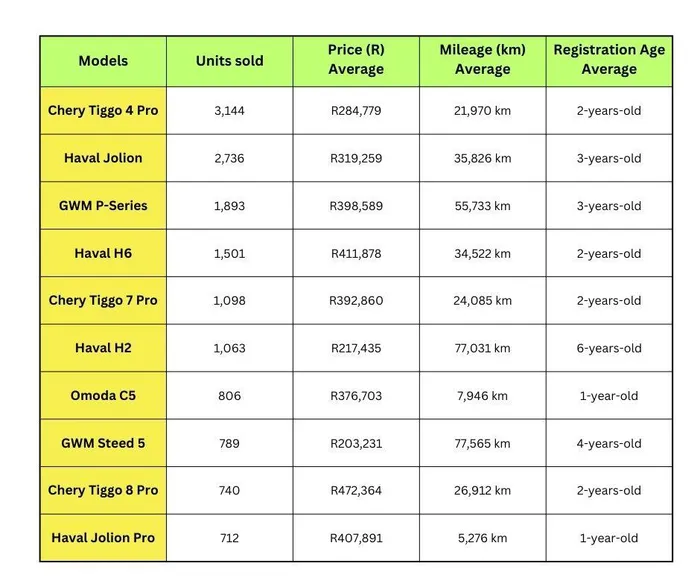

According to AutoTrader’s latest figures, these were the 10 best-selling used Chinese vehicles in South Africa in 2025, and here they are and why that is:

Chery Tiggo 4 Pro

The Tiggo 4 Pro tops the list, reflecting its dominance in the new-car market. With 3,144 used units sold last year, the compact crossover appeals through a wide range of derivatives and competitive pricing. At an average price of R284,779, with just 21,970km on the clock and a typical age of two years, it remains one of the most affordable options on the list.

Haval Jolion

Close behind is the Haval Jolion, which recorded 2,736 used sales. Slightly more expensive at R319,259 on average, Jolion models tend to be older and more heavily used, suggesting buyers are opting for higher-spec versions. The newer Jolion Pro also features in the top 10, albeit at a higher price point.

GWM P-Series

The P-Series stands out as one of only two bakkies in the top 10 — and as one of the best-selling used double cabs overall. Despite an average price of R398,589, its combination of value, styling and practicality has found favour with buyers. Average mileage sits at 55,733km.

Haval H6

A familiar sight on South African roads, the H6 continues to perform strongly on the used market. With 1,501 units sold, buyers are securing relatively young examples — typically two years old — at an average price of R411,878.

Chery Tiggo 7 Pro

The Tiggo 7 Pro reinforces Chery’s growing presence, with 1,098 used sales. Priced at R392,860 on average and showing modest mileage, it offers a balance of space, comfort and modern features.

Haval H2

Despite being discontinued, the H2 remains a popular used buy. Often credited as the model that helped legitimise Chinese SUVs locally, it offers an affordable entry point at R217,435 on average. Its higher mileage and age underline buyer confidence in older Chinese models.

Omoda C5

The C5 is the newest name on the list, yet already a strong performer. With just 806 used sales, its presence is notable given its youth. Low mileage and a one-year average age suggest many examples are nearly new.

GWM Steed 5

More basic than the P-Series, the Steed 5 continues to attract budget-conscious buyers. At just over R203,000 on average, it prioritises practicality over polish.

Chery Tiggo 8 Pro

The largest and most expensive vehicle on the list, the Tiggo 8 Pro still found 740 used buyers. Its seven-seat layout and premium features help justify an average price of R472,364.

Commenting on the trend, AutoTrader CEO George Mienie said Chinese manufacturers have successfully narrowed the gap between price and perceived value.

“Chinese OEMs have learned how to deliver around 80% of the consumer experience at roughly 60% of the price of traditional players,” he said, adding that informed buyers are increasingly prioritising value over brand heritage. And that’s no joke!

At a glance:

According to AutoTrader’s latest figures, these were the 10 best-selling used Chinese vehicles in South Africa in 2025, at a glance

Image: Graphic by Lance Fredericks / DFA