Women lead the charge in homeownership and vehicle ownership in South Africa

In South Africa, women are increasingly asserting their financial independence and making significant strides in both homeownership and vehicle ownership

Image: Freepik

As South Africa celebrates Women’s Month this August, fresh data reveals a compelling narrative of transformation in ownership dynamics. Women in South Africa are not only asserting their financial independence but are also increasingly becoming prominent figures in the realms of home and vehicle ownership.

This shift underscores a newfound dominance in property investments that, until recently, were predominantly male domains, according to Lightstone Property's Hayley Ivins-Downes.

“We’re seeing a clear and steady shift in ownership patterns as more South African women take on property purchases, reflecting both growing financial independence and confidence in property as a long-term investment. It’s an encouraging sign of transformation in the real estate sector.”

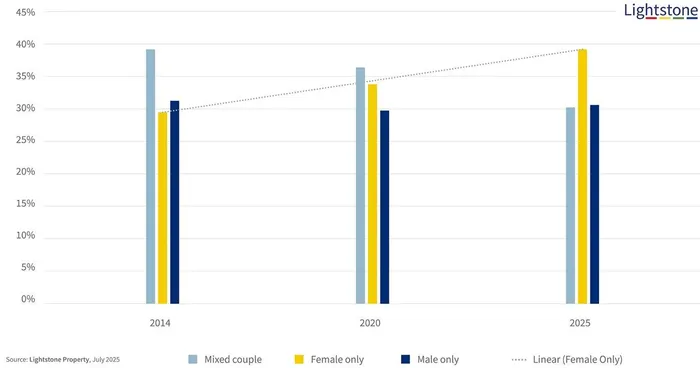

Property ownership over time 2014-2025

Image: Supplied

Historically male-centric property ownership is showing a paradigm shift, as the latest figures indicate that women are now outpacing men in the housing market. The proportion of homes owned by women as sole buyers has risen sharply from 30% in 2014 to an impressive 39% by 2025.

In contrast, the share of mixed couple ownership has declined from 39% to 30%. Notably, “single female buyers” are defined as women who are the sole registered owners of the property irrespective of their marital or relationship status.

This burgeoning ownership trend has far-reaching implications; properties owned exclusively by women or jointly with men now account for a staggering 69% of all ownership, while men’s ownership remains fixed at 31%.

Lightstone’s analysis reveals that out of approximately 200,000 residential property transactions conducted by natural persons in the last year, a remarkable 140,000 involved sole buyers, with 75,000 of those transactions attributed to sole women buyers. Additionally, around 60,000 transactions were joint purchases where women partnered with male buyers.

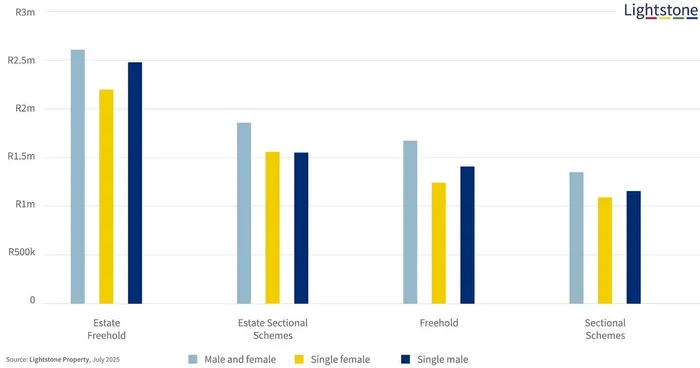

Average purchase price

Image: Supplied

The upward trajectory of women-only buyers is notable, particularly between July 2024 and June 2025, driven largely by a surge in low-value property transfers.

This shift is further illustrated in the affordable property price ranges, where sole women buyers significantly outnumber their male counterparts, especially in the categories below R250,000, R250,000–R500,000, R500,000–R750,000, and R750,000–R1 million.

Government-assisted housing programs also feature prominently in this trend, with 26% of transfers to women as exclusive owners being subsidised, compared to 21% for sole men buyers and 17% for joint male/female buyers.

When these subsidised properties are set aside, it becomes evident that women buyers show a marked preference for secure living environments: 12% favoured Estate Freehold, 4% opted for Estate Sectional Schemes, and a substantial 37% chose Sectional Scheme properties.

Just over 47% of single women buyers entered the Freehold market.

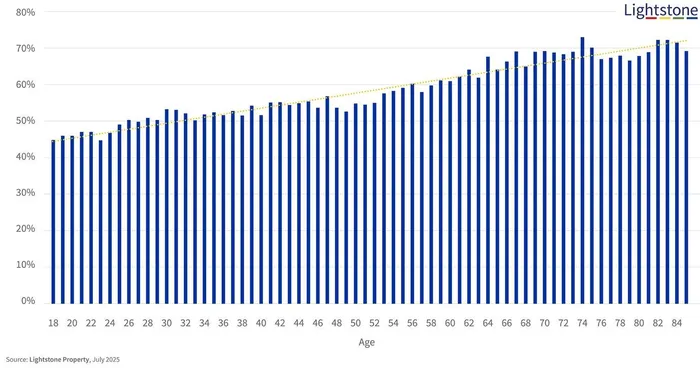

Percentage of single women buyers by age

Image: Supplied

Financially, women buyers tend to spend less on average than men, with women paying nearly R2.2 million for Estate Freehold properties and just over R1.5 million for Estate Sectional Scheme properties, excluding subsidies.

Moreover, female buyers demonstrate a clear trend towards ownership as they age; at 30 years, women constituted 50% of buyers, a statistic that climbs to 73% by the time they reach 74 years of age, showcasing a preference for sectional title properties.

This data not only highlights women's increasing clout in the property market but also reflects broader societal changes and growing empowerment.

IOL