Here's what South Africa's top CEOs are earning

South Africa's CEOs are coining it but that comes with great responsibility.

Image: File

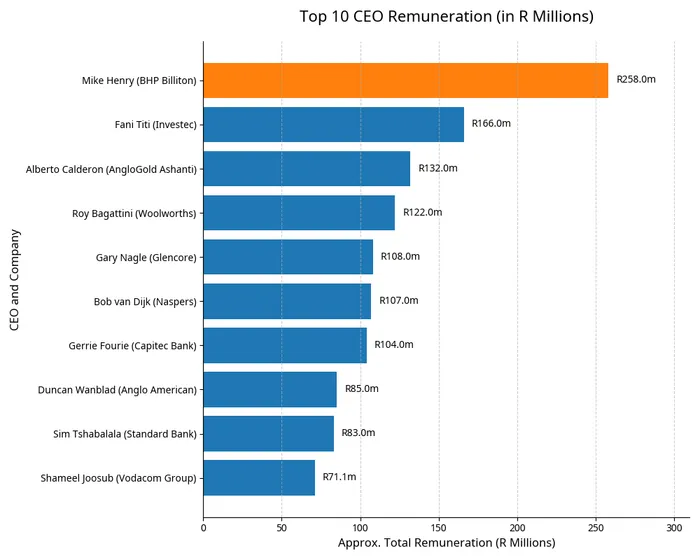

In 2025, several of South Africa's leading CEOs received substantial compensation packages, which included salaries, bonuses, long-term incentives, and, in certain instances, exit deals.

The pay packages span various sectors, including banking, telecommunications, mining, and retail, and are closely linked to company performance and shareholder returns.

They also reflect the responsibilities of managing some of the country’s largest and most complex businesses.

According to website Legal Advice, there is a CEO in South Africa who earns more than your entire neighbourhood combined.

"His name is Mike Henry from BHP Billiton, and he tops the list of the highest paid CEOs in South Africa for 2025–2026.

"This is the man who could buy a brand-new luxury car every single day and still be left with change large enough to pay a full year’s salary to dozens of employees," the website said.

Gerrie Fourie — Capitec Bank — R104 million

Gerrie Fourie earned around R104 million, including short- and long-term incentives, in his final year as Capitec’s CEO.

Fourie transformed the bank from a small challenger into one of South Africa’s retail-banking giants, growing its customer base, profitability, and market value

Capitec’s strong financial performance, headline earnings growth, return on equity improvements, and a surge in share price, helped drive his pay.

His exit package highlights how leadership changes at well-performing firms can coincide with hefty rewards for long-term value creation.

South Africa's top CEOs took home millions in 2025

Image: Manus.ai

Shameel Joosub — Vodacom Group — R71.1 million

Vodacom CEO Shameel Joosub took home about R71.1 million recently, including salary, bonuses, long-term incentives, and perks.

Vodacom’s share price rose about 30% over the year, reflecting strong company performance that contributed to his pay.

Joosub’s package shows how leaders in capital-intensive, consumer-facing sectors benefit when their companies deliver growth, stability, and market-recognised performance.

Bob van Dijk — formerly Naspers/Prosus — R330 million

Bob van Dijk earned a reported R330 million before leaving the company in 2023.

At the helm of Naspers/Prosus, he built a global tech-investment empire spanning online classifieds, fintech, media, and internet ventures.

The group’s strong global footprint and sustained investment performance underpinned his exit and bonus-heavy payout, including share-based incentives and severance.

His package was more a “send-off + long-term reward” than a regular salary.

Mike Henry — BHP Billiton — R258 million

Mike Henry, BHP Billiton’s CEO, earned over R258 million.

The global mining giant posted solid results across multiple commodities and regions, reflecting both operational scale and market conditions.

His compensation includes long-term and share-based incentives, highlighting how mining-sector executive pay scales with global scope, corporate size, and shareholder returns.

Fani Titi — Investec — R145 million

Investec CEO Fani Titi earned roughly R166.7 million, boosted by long-term and performance-linked incentives.

The company delivered steady results despite macroeconomic volatility, showing resilience in the banking and financial services sector.

Titi’s pay underscores how financial-sector CEOs are rewarded when leading institutions with major responsibilities in a challenging environment.

Alberto Calderon — AngloGold Ashanti — R132.7 million

Alberto Calderon, CEO of AngloGold Ashanti, took home about R132.7 million, reports indicate.

AngloGold Ashanti’s solid operational performance across multiple mines and countries, combined with navigating global commodity cycles, underpinned his compensation.

Calderon’s pay reflects the challenges and risks of leading a multinational gold-mining firm in a volatile sector.

Roy Bagattini — Woolworths — R80 million

Woolworths CEO Roy Bagattini earned roughly R79.9 million.

The retailer saw a drop in earnings and missed short-term targets, meaning no bonus was paid, but long-term incentives and vesting share awards kept his pay high.

Bagattini’s package shows how executive remuneration can remain substantial even when short-term performance falls, particularly in retail, where strategy, brand strength, and international exposure matter.

Get your news on the go, click here to join the Cape Argus News WhatsApp channel.

Cape Argus