SARS Commissioner urges social influencers declare all income for tax compliance

The South African Revenue Service (SARS) has clarified how social media influencers must declare their income, stressing that all earnings, including cash, products, services, and perks, are taxable

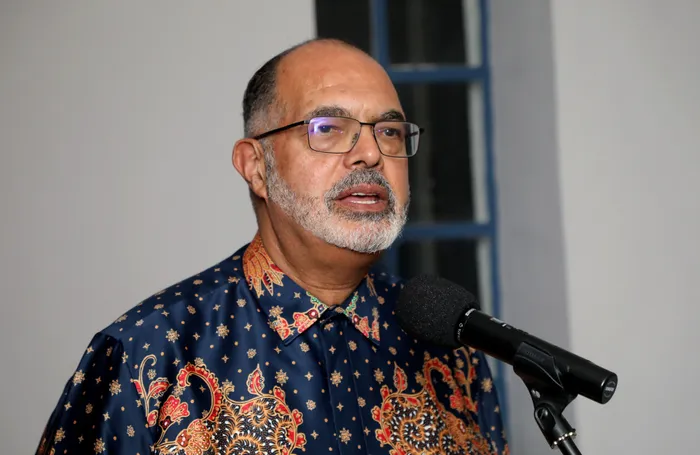

Image: Timothy Bernard / Independent Newspapers

The South African Revenue Service (SARS) has clarified how social media influencers must declare their income, stressing that all earnings, including cash, products, services, and perks, are taxable

IOL previously reported that South African social media influencers are being warned to get their tax affairs in order, as SARS is investigating undeclared income earned through online content creation and partnerships.

The news sparked concern among many influencers, who argued that understanding tax obligations can be confusing, especially for those new to the digital economy or earning non-cash benefits.

In a statement issued to the media on Friday, the revenue service said it recognises social influencers as a distinct taxpayer segment and is committed to providing clarity and support to help them meet their tax obligations

"When managing this segment, SARS will handle each such situation on a case-by-case basis according to current income-tax brackets. Some of these cases may generally fall into the provisional taxpayer category".

"For each of these segments, SARS has an engagement model whose first step is to provide clarity and certainty and to make it easy for taxpayers to comply. We work with and through stakeholders and partners to deliver SARS’s mandate".

The statement also clarified that social influencers, often classified as sole proprietors or independent contractors, must declare all income, regardless of form

“Full voluntary disclosure is critical. No matter how social influencers are remunerated — whether with products, services, or travel — all of these are deemed as income (ITA) and must be taxed accordingly

"SARS believes that social influencers will declare honestly when adequately educated. In this regard, SARS has prepared products and videos to help these taxpayers to meet their obligations. SARS aims to do much more in terms of outreach and education. It will also provide seminars and webinars as well as rulings to educate taxpayers about their obligations".

SARS Commissioner, Edward Kieswetter, said that the revenue service was 'looking forward to working with this segment to provide clarity and certainty, but also to provide them with a seamless taxpayer experience”.

He stressed that “SARS is more than willing to assist honest taxpayers to comply with their tax obligations. I am reminding social influencers to uphold their end of the bargain”.

IOL Business

mthobisi.nozulela@iol.co.za